If you’re looking for a dividend, then The Gym Group (LSE: GYM) isn’t probably the best fit for your money, as its yield is just 0.6%. But, if you’re looking for huge upside potential in the short term plus great prospects for dividend increases in the future, then I believe GYM is a healthy addition to your portfolio.

Established in 2007, with the goal of providing low-cost fitness to everyone without requiring a contract membership, The Gym quickly expanded across the UK. Having opened its first fitness club in 2008, the company reached 7,000 members by year-end. With an aggressive growth strategy plan, The Gym went public in 2015, raising £125m in cash that has been spent to expand the business.

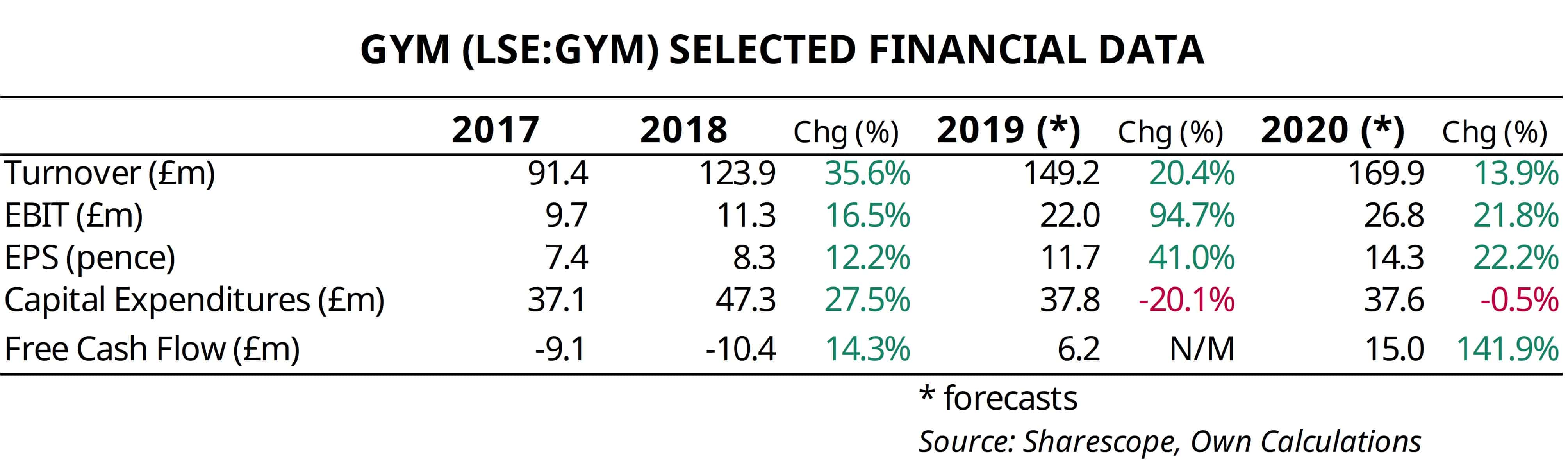

According to the latest reported numbers, The Gym generated £123.9m in sales in 2018, which spreads over a respectable footprint of 158 clubs and 724,000 members. These numbers convert to an average revenue of £784,000 per club and £171.1 per member (£14.3 on a monthly basis). Such figures are impressive and give The Gym a 25% share of the low-cost fitness market currently.

Negative sentiment

Between November 2016 and September 2018, The Gym’s shares went on an impressive run, rising 116% from 159p to an all-time high of 343p. But the shares took a hit in the third quarter of 2018 and declined 46% to 186p in March 2019. The end of 2018 was a rough period for equities in general, and for small caps in particular. Moreover, investors were becoming anxious about The Gym’s weak returns. While profitable, The Gym’s return on capital employed (ROCE) has been hovering around 6, which is on the low side. At the same time profits have been too low relative to the stock’s price, pushing the price-to-earnings ratio to values around 30.

But the last reported profits showed a strong 2018, with sales growing 36% to £123.9m, and earnings up 12% to 8.4p per share. The City estimates revenues to grow £150m this year and £170m next year, and earnings per share (EPS) to grow to 11.7p this year and 14.3p next year

Good prospects for the near future

The positive sentiment deriving from the last reported profits and upgraded forecasts are already reflected in the 22% price jump over the last few weeks. Still, shares are trading at 227p, which is 51% below their record high close of 343p.

One key reason for The Gym showing poor return on capital and negative cash flows is the amount invested back on its own business through capital expenditures. For each £1 in sales, 38.2p is invested back. By this metric, The Gym is a top 15 entry in the FTSE All-Share. But such an aggressive growth strategy is allowing The Gym to become a leader in the low-cost fitness market, which should help on future profits. At the same time, money invested back in the business will decrease, freeing up funds to potentially increase dividend distributions.

I foresee a large upside potential for the shares, and believe they’re due a recovery to at least the previous high at 343p in the near term.